Prior to evaluate how the cancellation of South Stream Natural Gas Pipeline Project will affect the European energy security, the process of South Stream Project should be put forward in order to better understand this cancellation decision.

European Union Energy Security and the South Stream Gas Pipeline Project

Kremlin’s general reaction to assertions from the European Union that they will endeavor to decrease their dependence on Russian gas has been a suspicious one.[1] Europe has repeated these allegations before especially after the 2006 and 2009 Ukraine crises however the fallouts have been insignificant. But, this somewhat positive Gazprom view to the threat of European supply diversification must juxtapose the fact that in reality both Gazprom and the Russian economy do possess an important need to sustain and even increase the sales to the region.

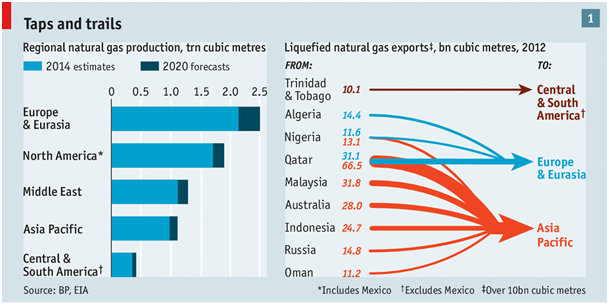

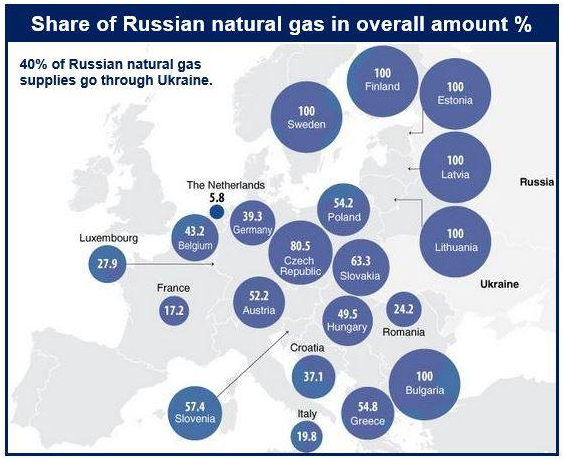

The natural gas constitutes one quarter of all energy consumed in the European Union. The import rate of the natural gas is 58 % in which 42 % of this does come from Moscow and approximately 80 % of EU imports of gas from Russia pass through Ukraine.[2] Among the 8 new eastern European Member States, the average dependence on Russian imports rate represents 77 %. Practically, about 300-350 million cubic meters per day of gas are delivered via Ukraine towards the EU, totaling approximately one fifth of total gas demand in the EU. Kyiv does transport the same quantity of gas on behalf of the EU as it does consume in its national market (around 300 mcm per day in winter). In November 2008, the European Commission has declared a revision to the Gas Security of Supply Directive 2004/67/EC in its assessment on the grounds that “today’s legal framework could be improved. In particular greater harmonization of security of supply standards and pre-defined emergency measures on regional and EU levels are needed”.[3] January 2009 is not only the situation that has represented the disruption of natural gas flows to the European Union. Tensions between Russia and Ukraine and Russia and Belarus have been outstretched several times since the dissolution of the Soviet Union owing to the enduring difficulties to settle on the details of a new gas transit and supply regime. The lack of a long term agreement has steered to several disputes translating into supply uncertainty at the start of calendar year. For the Union, pertaining to EU’s gas supplies from Russia transiting via Ukraine, the most serious disruption before that of January 2009 happened in January 2006. On that occasion, gas supplies to the EU were reestablished after one day of disruptions and accessible storage capacities easily pretended the shortfall (some 80 mcm).

Source: http://www.marketbusinessnews.com/wp-content/uploads/2014/04/Russian-natural-gas_min.jpg.

On 17th January, Moscow did host a high level summit in Moscow together with the Union and the Russian and Ukrainian representatives. This brought abouta deal between Russian Prime Minister Putin and Ukrainian Prime Minister Timoshenko on 18th January.[4] On 19th January, within the context of this political agreement, Gazprom and Naftogaz did contract new 10-year agreements on the purchase of gas by Ukraine and the transit of gas to the EU via Ukraine. On 20th January, normal gas transit towards the EU was startedagain. The Union was not the only target of the crisis. Other non-EU countries in south-east Europe did encounter important disruptions to their energy supply, with the international community moving in to supply emergency fuel aid to Moldova. Finally, both Moscow and Kyiv have experienced damage to their reputations as trustworthy energy partners for the EU andample losses of revenue (for example Gazprom projects its lost sales to the EU to be approximately $2 billion in the first three weeks of January).[5]

Russian Gazprom and Italian ENI took on a MOU to construct the South Stream Gas Pipeline from Russia to Italy in June 2007. This 3,200 kilometer pipeline, with envisaged capacity of 30 bcm a year, would run across the Black Sea (900 km.) from Russia to Bulgaria, bypassing both Ukraine and Turkey.[6] This pipeline will increase the Brussels’ dependence on Russian energy supplies. It challenges the proposed extension of the EU-backed SCGP via Turkey either to connect to Nabucco pipeline or persist to Greece and Italy. Most fundamentally, South Stream rivals directly with the EU and U.S.-supported Nabucco project. Given the delays experienced in Nabucco Project, Ankara and Moscow signed an agreement on December 29, 2011.[7] Putin has expressed his satisfaction numerous times for the completion of such a great project that the both countries would have prioritized on energy field as well.

Russia’s Gazprom assumed that it has to make investment around 12.5 billion Euros ($16.8 billion) to make its domestic gas pipeline system compatible with the scheduled South Stream undersea link to Europe, aggregating the project’s already high cost.[8] The extra expense drives the overall cost to 29 billion Euros for the South Stream project under the Black Sea, intended to bypass countries such as Ukraine and Belarus. The bulk of Russia’s gas exports to Europe currently must pass through them. Many analysts indicate that Gazprom is encumbered with inefficiency, high costs and an inflated investment programme. Kremlin’s gas export monopoly had earlier appraised costs for South Stream at 16 billion Euros, including 10 billion for its subsea section. Gazprom has additionally allocated 509.586 billion rubles ($16.9 billion) of its long-term investment programme for an advancement of its domestic pipeline system as part of the project. On March13, 2014, South Stream Board members recently approved the signing of a contract for laying the first string of South Stream’s offshore section and a pipe procurement contract for the second string of the gas pipeline offshore section.[9] On May 16, 2014, Aleksey Miller, Chairman of the Gazprom Management Committee participated in the South Stream Transport Supervisory Board of Directors meeting in Amsterdam. It was underlined in this meeting that South Stream’s offshore project was ongoing as planned. At present, South Stream Transport has finalized all the contracts necessary for the offshore gas pipeline to pass the construction stage in autumn 2014.

The fundamental benefit of both Nord Stream and South Stream pipelines for Gazprom is that they would supply gas directly to Europe, thus eradicating all transit risk. Nonetheless this gas will still have to be conveyed across multiple borders and over long distances inside Europe before it does reach LTSCs delivery points – the geographical location of which does go far beyond the Russian border.[10] Such conveyance is ruled by the EU Third Energy Package (TEP) adopted in 2011; this orders regulated third party access (TPA) to pipeline capacity based on published tariffs (or their methodologies) approved by national regulatory authorities (NRAs)[11], unbundling of transmission assets, and certification of transmission system operators (TSOs). Notably the TEP in its current form does not arrange for a procedure for the construction and utilization of new pipeline capacity, even though such a procedure is being developed by European regulators, TSOs, and the European Commission (EC), in the form of a Capacity Allocation Mechanisms Network Code (CAM NC)amendment; this is anticipated to come into effect in 2017/18. Till the development of this procedure, allpipeline capacity (existing and new) would be evaluated the current TEP rules – unless an exception isestablished by an NRA and ratified by the EC. Thus, although transit-avoidance pipelines would potentially launch a transit-free geography for Russian gas exports to Europe, thus resolving a problem of insecure transit, they do encounter another central problem that is to with the changing European regulatory environment.

Moreover, the Union, which has contracted and approved an association agreement with Ukraine[12], would be in a hard position for backing South Stream as it would further lessen the Kyiv’s transit power and its leverage against Moscow. If Kyiv does select to apply this instrument impede with transit flows, the south east European countries (including some EU and some non-EU EnCT member states) would be victims of supply cuts; these areas have restricted means to considerably increase their security of supply prior to 2020. In case of the becoming operational of first line of South Stream in late 2015, which would be carrying Russian gas directly to south-east Europe, then the 2015/16 winter would represent the last one when the region’s security of supply does linger subjected to transit risk.[13] If Ukrainian transit does linger a fundamental risk, as probably appears, and then the EC will be encountering pressures from Southeast European countries for settling with Kremlin, particularly if the offshore section of the pipe will have been finished on time in 2015. This does leave the EC with a very hard choice to make in respect of South Stream.

Gazprom also does face a demanding choice to make. In the face of European plans to differentiate away from Russian gas, it may well expend billions of Euros on new pipeline capacity in a bid to show that augmented security of transport is being presented, effectively setting up a transit-free geography for its European exports. However, this does pose the risk of an inability to use pipeline capacity at a level sufficient for redirecting gas streams from the current transit corridors, owing to the TEP requirements. Alternatively, Gazprom may possibly stop all its pipeline plans, leaving Europe at the mercy of the current transit pipeline infrastructures and all the transit issues intricate. The threat of this strategy is that it possibly will further reinforce the resolve of Europe to branch out from Russian gas. Additionally, in following such a course of action, Gazprom would depict itself into the danger of fading to supply on its prevailing European Long Term Supply Contracts owing to a shortage of trustworthy transit capacity, thus potentially losing billions of dollars in damages and distressing further reputational losses. The 2014 Ukrainian political crisis seems to have further empowered Gazprom’s resolve to select the first option in which it has been seriously backed up by Kremlin. With large components of South Stream apparently ongoing – onshore Russia has been placed already and the Black Sea offshore beginning in late 2014- the Union and its member states will have to decide very soon.

Source: https://syncreticstudies.files.wordpress.com/2014/12/gas_to_eu_final_3.png.

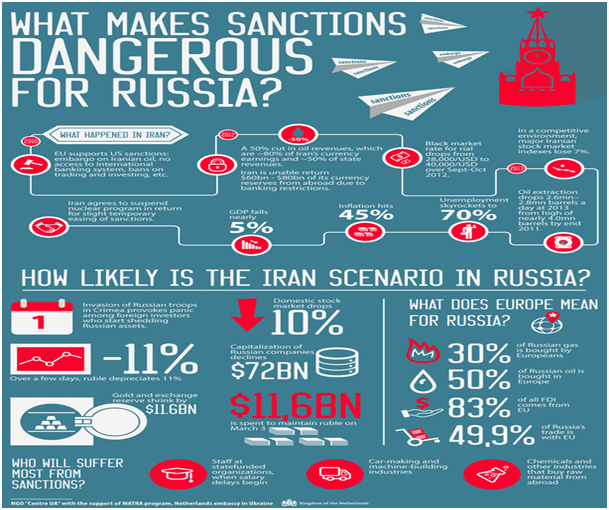

After the ousting of President Yanukovich by pro-European protestors on Kiev’s Maidan in February 2014, Moscow has seized the control of Crimea.[14] Unfolding violent unrest in Eastern Ukraine, the gathering of Russian troops at Russian-Ukranian border and Kremlin’s disobedience to the April 2014 Geneva Agreement intended for lowering the accelerating tension between Brussels and Washington on one side and Moscow on the other. The consequence has been the most serious conflict between East and West since the dissolution of the Soviet Union, with possibly long term foreign policy impacts. Energy has turned out to be a hot issue in the political debates during the crisis. Andreas Golthau and Tim Boersma have put forward some alternatives on the energy supply issue within the context of ongoing Ukraine crisis which are as follows;

|

In this point, how the energy issue within the context of recent Ukraine Crisis is viewed by the United States. Washington and Brussels organized “Energy Council” last week. In that Council, U.S. Secretary of State John Kerry has remarked that “But I’m pleased to be here with all of you, and let me begin by applauding the tremendous leadership of the EU in helping to reach a gas deal with respect to Ukraine. That is a very important deal, and it is very successful with respect to the long-term situation. It’s important. And part of our meeting today is really to talk about providing a sustainable energy plan for Europe – for actually more than Europeans – so that all of us can deal not just with issues like climate change, but the economy and the stability of the economy and the stability of the supply. And obviously, it’s not a good idea to depend anywhere in the world on one source. There are disruption and vast implications.”[15]

The Cancellation of the South Stream and Its Implications

Given the ongoing political crisis between Kyiv and Moscow, Brussels has put off the approval process for the South Stream and instead has begun to favor the pipeline projects to bring natural gas from Baku. On December 1st, 2014, Russian President Vladimir Putin together with 10 ministers has paid an official visit to Ankara,Turkey.[16] In that visit, very significant decisions on energy issues have been made by Moscow and Ankara. Among those decisions, the cancellation of the South Stream Natural Gas Project by Kremlin has come into forefront. Mr. Putin had declared the cancellation of the South Stream Pipeline during his visit to Turkey, mentioning opposition from the European Union as the reason for the decision. After the Moscow’s decision to postpone the South Stream Gas Pipeline Project, Gazprom and Botaş have reached a deal on a Memorandum of Understanding for the construction of an offshore gas pipeline across the Black Sea toward Turkey. Gazprom’s Management Committee Chairman Aleksey Miller and Botas Petroleum Pipeline Corporation’s Chairman Mehmet Konuk in Ankara, Turkey did sign this MoU. The Russian President Vladimir Putin and Republic of Turkey President Recep Tayyip Erdoğan have also participated to this signing ceremony. The recently offered gas pipeline to Turkey would do hold a capacity of 63 Bcm, with 14 Bcm to be committed to Turkey, and roughly 50 Bcm to be transported to the border between Turkey and Greece, where a conveyance point would be decided. The Russkaya compressor station currently under construction in Russia’s Krasnodar Territory is anticipated to be the pipeline’s beginning point. Other details of the project are hitherto to be publicized.

Vladimir Putin has also stressed that “We believe that in the current conditions Russia cannot continue with the realization of this project [South Stream].[17] Bearing in mind that you need to construct the pipeline under the Black Sea, we cannot begin construction so long as we do not have permission from Bulgaria. To begin construction in the sea, get to the Bulgarian beach, then stop – it would be ridiculous. The position of the European Commission was not constructive … If Europe does not want to realise it, well, then, it won’t be realized.

According tothe statement’s given by Gazprom Head Aleksey Miller last Saturday “Kyiv’s role as a natural gas transit region between Russia and the European Union will be “invalidated” once a newly declared pipeline via Turkey to Greece becomes operational.”[18] But Miller’s eagerness on the construction of a Turkish gas line, intended to take the place of the newly sparred $40 billion South Stream pipeline via Sofia, may be inappropriate. The expected high cost of the project, Ankara’s powerful negotiating stance and unresolved political concerns mightprofoundly be costing for Kremlin. Neither Miller nor Russia’s President Vladimir Putin has so far detailed what route the new pipeline will yield from Russia to Turkey or which investors in Turkey are available for sponsoring the project. They have yet stated who would have got to construct or enlarge the current pipeline network from Turkey to Greece. During Rossia-1’s program “The News on Sunday,” Miller has addressed that nearly 4 billion Euros ($5 billion) of infrastructure already assembled for the sparred South Stream project can be repurposed for transit to Turkey. Mikhail Korchemkin, head of East European Gas Analysis, a U.S.-based energy consultancy has emphasized that due to Gazprom’s current projects, however, counting an enormous pipeline being constructed to deliver natural gas to Beijing, Gazprom can barely manage to pay for to a new pipeline”. Mikhail Krutikhin, a partner and analyst at the Russia-based RusEnergy consultancy has stressed the fact that and even supposing the pipelines are put up to Turkey, it is vague who will possess and drive and on what conditions.

Moscow’s decision to construct the South Stream natural gas pipeline to Europe was a bad plan.[19] The EU Commission’s rejection of the construction of this pipeline can be viewed as equally bad decision from economic perspective. The Russian gas will also be streaming to the European Union but it will occur through another transit country rather than a direct one. When one mentions soap operas in energy issues, Kremlin or the EU officials in Brussels represent the “Number 1” players. The EU does have a huge population and the environmental lobbies are getting more powerful. It is an undeniable fact that the European Union will be required to import gas transported via pipelines. New pipeline projects aiming at carrying natural gas from Baku into the European Union through Turkey are currently on the way to construct however probable quantities do represent relatively small, definitely much smaller when compared with the volume considered to carry with the South Stream.

Getting natural gas from Central Asian countries is a self-delusion that as the fundamental producer Ashgabat does hold a huge commitment to Beijing and is situated on the wrong side of the Caspian Sea. When it is considered within the perspective of Ankara, the new gas deal with Kremlin is a great achievement. Enlarging the capacity of the current Blue Stream Natural Gas Pipeline does greatly contribute to the country’s energy security and at a respectable price. The decision made to construct a new pipeline from Russia will help Ankara in reaching its target to turn out to be a central energy terminal of the European Union. Ankara is also holding the Trans-Anatolian Natural Gas Pipeline, possessing an envisaged capacity 16 bcm gas from Baku to Europe, with first deliveries anticipated in 2018.This Russian proposed natural gas pipeline will greatly augment the importance of Ankara to the Union within the context of energy security and also does bring the Union much more in need of Ankara. Ankara has unsuccessfully endeavored for several years in progressing concerning the EU membership and in reality it seems to be a totally dead probability now. One can easily observe the deadlocks in the numerous political fields in this relationship. It is wondered the reasoning of Brussels stalling a direct gas pipeline from the gas source in favor of growing reliance, and vulnerability, to hitherto another transit country.

Kenneth Yalowitz, a fellow at the Woodrow Wilson International Center for Scholars and former U.S. ambassador to Belarus and Georgia addresses that “Canceling South Stream is a significant political defeat” for Putin. “He had put a lot of his own prestige into this. What he did by going to Turkey is take this defeat and try to turn it into something that looks like a victory.[20]” As stated by Yalowitz, “For the Russians, Turkey is a tougher customer compared to Ukraine, which this pipeline is designed to bypass, when it comes to negotiating with Moscow. Turkey will cut hard deals and Putin already had to reduce the price of gas to Turkey. So there are already questions about how much Russia is going to gain economically from this deal.” Yalowitz also underscores that “While energy and wider economic ties are strong between Russia and Turkey, political ties are more tenuous. “They disagree over Syria in a major way.”As another perspective; Henri Barkey, a professor of international relations at Lehigh University stresses that“Russia shipping gas through Turkey, bypassing Ukraine, makes Turkey more important” to Russia, says. Energy is already one of the cornerstones of Russia-Turkey relations. Last year, more than half of Turkey’s gas imports came from Russia, and Turkey is Russia’s second-largest buyer of gas.But this new pipeline brings with it potential concerns for both sides. “The Turks are vulnerable on the price” of gas. Right now there is a glut. In the future, Russia could jack up the price. Once the gas infrastructure is in place, you’re stuck.” Furthermore he does remark that “They disagree over Ukraine in a major way. Turkey is very concerned about the Crimean Tatars and other aspects of what the Russians are doing” he adds, referring to an ethnically Turkic minority population in Crimea, which Russia annexed from Ukraine earlier this year.” Moreover, Barkey highlights that “Here’s Turkey—member of NATO and ally of the U.S.— and the Turkish president almost daily lambasts the West because the West has not intervened to overthrow Assad,” referring to the president of Syria, Bashar al-Assad. By contrast, Putin, the primary guy that supplies all the arms to Assad, gets no criticism from Erdoğan. Turkey’s commercial interlocutor is the Russian state. In that sense, Erdoğan cannot afford to alienate Putin. The relationship between Turkey and Russia is different than the relationship between Turkey and any of its allies, where Turkey deals mostly with private companies. In Russia it deals with the state.”

Declaring the project’s invalidation, Vladimir Putin has underlined that “Bulgaria had been “deprived of the opportunity to act as a sovereign nation”, laying the blame squarely at the feet of Washington and Brussels. As an alternative, Kremlin would reach a natural gas agreement with Ankara.[21] It can be speculated why Ankara has chosen to basically flaw. Perhaps it has been presupposed by Washington and Brussels; or the decades-long accession negotiations with the EU, clearly anticipated to last forever without a result; or that Washington’s plans did leave little room for Ankara’s own plans for Turkey’s regional hegemony. Whatever the reason, the Turks have selected to reach an agreement with their former enemy rather endorse the dictates of the EU and the US. Taking into account the fact that Ankara has represented a central NATO ally, but also the sine qua non of all American initiatives for bypassing Kremlin with oil and gas pipelines (Nabucco, Baku-Tbilisi-Ceyhan), Ankara’s gas agreement with Moscow does turn the South Stream out to be a great defeat for the United States. Brussels is the loser in both ways: Europe does hold any alternative Russian gas; therefore its rejection to South Stream has been on politics of extortion, on no occasion regarding economic logic. Belgrade and Sofia will encounter the unpleasant consequences of behaving like banana republics. Budapest will also undergo, but the denunciation for that does lie with the EU rather than Kremlin.

According to David Koranyi, Director, Eurasian Energy Futures Initiative at the Atlantic Council, “everybody wins in the demise of South Stream at least from a strategic perspective”. He stresses that “it’s a win for both Russia and Europe, because it became clear that this was not a project that made commercial or political sense from the European perspective; nor it is the best way to stabilize the European-Russian energy relationship”.[22] Moreover, he points out that “the situation is good for facilitating a healthier debate around energy sector reform in Ukraine and will help concentrate minds when the 6-month temporary deal expires between Russia and Ukraine to come up with a sensible, permanent and transparent transit regime that also makes commercial-political sense”.He discourses that this represents an indication that the sanctions against Russia may be effective, putting additional pressures on Russian finances in general and Gazprom’s finances in particular. “It did make it more difficult for Gazprom to access financing to get the South Stream project up and running.”

Source: http://www.kyivpost.com/media/images/2014/03/30/p18k9qceh1a8oiud17p21jo41e724/big.jpg.

Koranyi underlines the fact that “the new pipeline in Turkey is at this point nothing more than a face-saving maneuver for Moscow. “They’re saying, ‘okay, we’re going to bring our gas through Turkey, instead of bringing it directly to the European markets”. Koranyi is also skeptical on the projections of recreation of South Stream through Turkey. Changing from Kyiv to Ankara is not sensible given the fact that a danger for transit passage continues. He also highlights that “You won’t have the same issues and baggage as with Ukraine, but you won’t really solve the problem either. As soon as you arrive at the EU border, EU law against which Gazprom so vehemently protested (unbundling, third party access) applies again. There may be chemistry between Presidents Erdoğan and Putin but the Turks won’t necessarily be easier transit partners.”Lastly he does mention that Ankara did lucratively leverage Kremlin’s distraction totake out price concessions from Gazprom. The Turkish market does represent a fast-growing market; they are endeavoring to branch out, however they will also be pleased to get cheaper Russian gas.

Vladimir Putin’s declaration on the cancellation of South Stream Project in his visit to Ankara with 10 ministers on December 1, 2014, dramatically rearranges the political energy map of Eastern Europe.[23] Putin can be viewed as the first loser in this maneuver. On the other hand much he did endeavor to put an annotation on the news; he did lose face and esteem, by being required to trench his standing project. Sofia and Belgrade can also be included among the losers. They will have got to forget to the vista of hundreds of millions of dollars of transit fees from South Stream. Brussels is able to rejoice an occasional political success, having supported to halt South Stream. Kyiv also does mark an occasional triumph, even as it does encounter catastrophe in many other fields. After all, Kremlin’s political logic behind endorsing South Stream was to go around Ukrainian territory. Ankara represents as the greatest champion. Ankara’s intentions to turn out to be an international gas hub are boosted, with the prospect of it getting great new gas supplies from Moscow, together with the volumes it does already import from the Caspian Sea, Northern Iraq, and Iran.The most stimulating issue is what does this mean for Baku which has started the awkward process of endeavoring to turn itself out to be an oil supplier to a gas supplier, due to the fact that Baku’s oil incomes start to decrease. Baku targets to supply gas to southern Europe via Turkey through the TANAP and TAP pipelines in the next five years.If this can be implemented, the new Russian-Turkish gas project may possibly be a challenger to Baku’s gas intentions and embrace the profit margins of that project even more. But the realization of a new Russian Black Sea pipeline would still be a difficult issue. In order to transport its gas to European markets, Gazprom would have got to benefit from the new TANAP pipeline, possessed by a consortium comprised of BP, BOTAŞ, TPAO and SOCAR as a central stakeholder. According to one Azerbaijani commentator “TANAP comes to be theforemost gas link”.

As the latest development on this issue, German Chancellor Angela Merkel has supported Sofia in its effort to search for new negotiations with Kremlin concerning the South Stream gas pipeline after Moscow did suspend the project this month in favour of an alternate route through Turkey.[24] It is believed that it is in violation of EU Law, but then some EU member states view the pipeline bypassing Ukraine, as the paramount way to guarantee their own gas supplies and economic interests and still hope it can be invigorated. After discussing with Bulgarian Prime Minister Boiko Borisov in Berlin has remarked that “We need to examine all legal questions surrounding the South Stream project and then use these to move discussions forward with Russia. Numerous contracts have already been agreed and it is important for both sides to remain reliable partners.” On the other hand, after talks with Merkel, Borisov has stated that “he was convinced that the problems could be resolved and he hoped to receive clarification from Brussels on its views about the pipeline.We think the Russian and Bulgarian partners must continue on a legal basis, otherwise we would violate the contract, which was signed with Bulgaria rather than with the EU as a partner in 2006.”

Conclusion

On December 1, 2014, Putin’s visit to Ankara with 10 ministers has resulted with significant results within the context of European energy security and regional affairs. In that visit, given Brussels’s reluctance on the construction of South Stream Gas Pipeline Project and the sanctions applied towards Kremlin for its Ukraine policy, Putin has put off South Stream Project and instead has put forward a new pipeline project with Turkey. This development is among one of the hottest issues in international politics since that date. Some believe that a new alliance is being formed among two former rivalries namely Ankara and Moscow. Others think that Europe does not think strategically when developing relations with Kremlin. It instead prefers to casts out Russian Federation by applying sanctions. By casting out Kremlin, Brussels paves the way for Russia’s forming new partnerships (400 billion-dollar natural gas sales agreement with China) and setting up new organizations (Eurasian Economic Union).

On the other hand, by preventing the construction of Russian South Stream Project, Brussels aims to penalize Kremlin and instead focusing on Southern Gas Corridor to ensure its natural gas supplies. But just taking into the consideration the Southern Gas Corridor and excluding Russia, in my opinion, this policy does not serve the strategic interests of the European Union. By just relying on one supply route, the Union cannot guarantee its energy supply security in the 21st century.

As a result of the annulment of South Stream and signing a new gas deal with Moscow, it is believed that Ankara is the greatest winner of these developments. Given its ever increasing energy demands, Turkey needs to get huge volumes of oil and natural gas in order to realize the sustainable development in its economy. Ankara also targets to turn out to be an international energy terminal within the context of its region. Ankara’s new gas deal with Kremlin will serve for this target. On Russia’s side, it will have not lost one of its greatest customers. Therefor these two countries will have increased their geostrategic, geoeconomic and geopolitical significances in the Eurasia region. President Erdoğan’s latest criticisms toward the European Union with regard to judicial operations held on December 14, 2014 in Turkey should be examined within the context of Ankara’s search for a more independent foreign policy and Ankara’s reactions to the double standard policy of Brussels in the accession negotiations. The European Union has to rationally behave toward Russian Federation and Turkey in order not to misplace them.

Therefore based on the abovementioned evaluations, it can be discoursed that the cancellation of construction of South Stream Natural Gas Pipeline Project and signing a new natural gas transportation deal between Moscow and Ankara will form one of hottest debates within the international politics context in the forthcoming years and will inspire new geopolitical developments within the Eurasia region in the 21st century.

Sina KISACIK

REFERENCES

– Bendavid, Naftali. “EU, Ukraine, Russia Reach Deal on Association Agreement”, The Wall Street Journal, September 12, 2014. Accessed December 13, 2014, http://www.wsj.com/articles/eu-ukraine-russia-reach-deal-on-association-agreement-1410546041.

– Bruno, Greg. “Turkey at an Energy Crossroads”, Council on Foreign Relations, November 20, 2008. Accessed February 9, 2013, http://www.cfr.org/turkey/turkey-energy-crossroads/p17821.

– Commission Staff Working Document, “Accompanying document to the Proposal for a Regulation of the European Parliament and the Council concerning measures to safeguard security of gas supply and repealing Directive 2004/67/EC The January 2009 Gas Supply Disruption to the EU: An Assessment {COM (2009) 363}, SEC (2009) 977 final, Brussels, July 16, 2009”, http://ec.europa.eu/energy/strategies/2009/doc/sec_2009_0977.pdf, Accessed December 8, 2014.

– De Waal, Thomas. “Winners and Losers in the Black Sea Gas Game”, Carnegie Moscow Center, December 3, 2014. Accessed December 16, 2014. http://carnegie.ru/eurasiaoutlook/?fa=57370.

– Dickel, Ralf, Hassanzadeh, Elham, Henderson, James, Honoré, Anouk, El-Katiri, Laura, Pirani, Simon, Rogers, Howard, Stern Jonathan, and Yafimava, Katja. “Reducing European Dependence on Russian Gas: distinguishing natural gas security from geopolitics”, The Oxford Institute for Energy Studies, OIES Paper: NG 92, October 2014, http://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/10/NG-92.pdf, Accessed December 1, 2014.

– Fraser Suzan and Isachenkov, Vladimir. “Putin says Russia will scrap South Stream gas pipeline”, Associated Press, December 1, 2014. Accessed December 9, 2014. http://bigstory.ap.org/article/957862a148154d40acf04bb13a3b2bde/putin-visit-turkey-amid-syria-differences.

– Goldthaua, Andreas and Boersma, Tim. “The 2014 Ukraine-Russia crisis: Implications for energy markets and scholarship”, Energy Research & Social Science 3 (2014), Elsevier, pp. 13-15, May 8, 2014. Accessed December 9, 2014. http://belfercenter.ksg.harvard.edu/files/The%202014%20Ukraine-Russia%20Crisis%20-%20Implications%20for%20Energy%20Markets%20and%20Scholarship.pdf.

– Hafner, Manfred and Bigano, Andrea. “Russian-Ukraine-Europe Gas Crisis of January 2009: Causes, Lessons Learned and Strategies for Europe”, Fondazione Eni Enrico Mattei Policy Brief, March 2009, http://www.feem.it/userfiles/attach/2009115123324Policy_Brief_2009_3.pdf.

– Hudson, Alexandra. “Merkel urges Bulgaria to seek new talks with Putin on South Stream”, Reuters, December 15, 2014. Accessed December 16, 2014. http://uk.reuters.com/article/2014/12/15/bulgaria-gas-southstream-idUKL6N0TZ2BS20141215.

– John Kerry Secretary of State, “Remarks at U.S.-EU Energy Council”, European External Action Service Brussels, Belgium, December 3, 2014. Accessed December 9, 2014. http://www.state.gov/secretary/remarks/2014/12/234652.htm.

– Leifheit, Drew. “Canceling South Stream: Everybody Wins”, Natural Gas Europe, December 11, 2014. Accessed December 15, 2014. http://www.naturalgaseurope.com/south-stream-dvid-kornyi.

– Malic, Nebojsa. “Turkey’s Gas Deal with Russia is a Geopolitical Game-Changer”, Russia Insider, December 8, 2014. Accessed December 14, 2014. http://russia-insider.com/en/business_opinion/2014/12/07/05-33-31pm/no_secret_behind_south_stream_cancellation_moscow_just_got.

– Official Journal of the European Union, “Regulation (EU) No 994/2010 of the European Parliament and of the Council of 20 October 2010 concerning measures to safeguard security of gas supply and repealing Council Directive 2004/67/EC (Text with EEA relevance), L 295/1, 12 December 2010, http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32010R0994&from=EN, Accessed December 16, 2014.

– Official Journal of the European Union, “Regulation (EU) No 347/2013 of the European Parliament and of the Council 17 April 2013 on guidelines for trans-European energy infrastructure and repealing Decision No 1364/2006/EC and amending Regulations (EC) No 713/2009, (EC) No 714/2009 and (EC) No 715/2009, (Text with EEA relevance), April 24, 2013, http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32013R0347&from=EN, Accessed December 9, 2014.

– Panin, Alexander. “Russia’s South Stream Alternative Rests on Shaky Ground”, The Moscow Times, December 7, 2014. Accessed December 8, 2014. http://www.themoscowtimes.com/business/article/512694.html.

– Pedersen, Jacob Gronholt. “Turkey Approves Russian Gas Plan”, The Wall Street Journal, December 29, 2011. Accessed December 8, 2014. http://www.wsj.com/articles/SB10001424052970204632204577126220469891132.

– Rettman, Andrew. “Putin says will not build South Stream gas pipeline”, EU Observer, December 2, 2014. Accessed December 8, 2014. http://euobserver.com/foreign/126749.

– Russia and Ukraine agree gas deal”, The Guardian, January 18, 2009. Accessed December 13, 2014. http://www.theguardian.com/world/2009/jan/18/russia-ukraine-gas-deal.

– Savel, Maria. “Energy Trumps Politics in Turkey-Russia Relationship”, World Politics Review, December 8, 2014. Accessed December 13, 2014. http://www.worldpoliticsreview.com/trend-lines/14612/energy-trumps-politics-in-turkey-russia-relationship#.

– Soldatkin, Vladimir.“Gazprom puts total South Stream costs at 29 bln Euros”, Reuters, January 29, 2013. Accessed January 30, 2013. http://www.reuters.com/article/2013/01/29/gazprom-southstream-investment-idUSL5N0AY72I20130129.

– South Stream Official Web Site, “All contracts for South Stream’s offshore construction signed”, May 16, 2014, accessed May 30, 2014, http://www.south-stream.info/en/press/news/news-item/all-contracts-for-south-streams-offshore-construction-signed/.

– Weafer, Christopher. “South Stream Cancellation Hits Europe Hardest”, Russia in Global Affairs, December 6, 2014. Accessed December 13, 2014. http://eng.globalaffairs.ru/book/South-Stream-Cancellation-Hits-Europe-Hardest-17167.

[1] Ralf Dickel, Elham Hassanzadeh, James Henderson, Anouk Honoré, Laura El-Katiri, Simon Pirani, Howard Rogers, Jonathan Stern & Katja Yafimava, “Reducing European Dependence on Russian Gas: distinguishing natural gas security from geopolitics”, The Oxford Institute for Energy Studies, OIES Paper: NG 92, October 2014, http://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/10/NG-92.pdf, p. 56, Accessed December 1, 2014.

[2] Commission Staff Working Document,“Accompanying document to the Proposal for a Regulation of the European Parliament and the Council concerning measures to safeguard security of gas supply and repealing Directive 2004/67/EC The January 2009 Gas Supply Disruption to the EU: An Assessment {COM (2009) 363}, SEC (2009) 977 final, Brussels, July 16, 2009”, http://ec.europa.eu/energy/strategies/2009/doc/sec_2009_0977.pdf, pp. 2-4, Accessed December 8, 2014.

[3] For more information on this issue, Official Journal of the European Union, “Regulation (EU) No 994/2010 of the European Parliament and of the Council of 20 October 2010 concerning measures to safeguard security of gas supply and repealing Council Directive 2004/67/EC (Text with EEA relevance), L 295/1, 12 December 2010, http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32010R0994&from=EN, Accessed December 16, 2014.

[4] “Russia and Ukraine agree gas deal,” The Guardian, January 18, 2009, Accessed December 13, 2014, http://www.theguardian.com/world/2009/jan/18/russia-ukraine-gas-deal.

[5] For a useful analysis on this issue please see, Manfred Hafner and Andrea Bigano, “Russian-Ukraine-Europe Gas Crisis of January 2009: Causes, Lessons Learned and Strategies for Europe”, Fondazione Eni Enrico Mattei Policy Brief, March 2009, http://www.feem.it/userfiles/attach/2009115123324Policy_Brief_2009_3.pdf.

[6] Greg Bruno, “Turkey at an Energy Crossroads,” Council on Foreign Relations, November 20, 2008, Accessed February 9, 2013, http://www.cfr.org/turkey/turkey-energy-crossroads/p17821.

[7] Jacob Gronholt-Pedersen, “Turkey Approves Russian Gas Plan”, The Wall Street Journal, December 29, 2011, Accessed December 8, 2014, http://www.wsj.com/articles/SB10001424052970204632204577126220469891132.

[8] Vladimir Soldatkin, “Gazprom puts total South Stream costs at 29 bln Euros”, Reuters, January 29, 2013, Accessed January 30, 2013, http://www.reuters.com/article/2013/01/29/gazprom-southstream-investment-idUSL5N0AY72I20130129.

[9] South Stream Official Web Site, “All contracts for South Stream’s offshore construction signed”, May 16, 2014, Accessed May 30, 2014, http://www.south-stream.info/en/press/news/news-item/all-contracts-for-south-streams-offshore-construction-signed/.

[10] Dickel, Hassanzadeh, Henderson, Honoré, El-Katiri, Pirani, Rogers, Stern and Yafimava, “Reducing European Dependence on Russian Gas: distinguishing natural gas security from geopolitics”, p. 65.

[11] Official Journal of the European Union, “Regulation (EU) No 347/2013 of the European Parliament and of the Council 17 April 2013 on guidelines for trans-European energy infrastructure and repealing Decision No 1364/2006/EC and amending Regulations (EC) No 713/2009, (EC) No 714/2009 and (EC) No 715/2009, (Text with EEA relevance), April 24, 2013, http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32013R0347&from=EN, Accessed December 9, 2014.

[12] Naftali Bendavid, “EU, Ukraine, Russia Reach Deal on Association Agreement”, The Wall Street Journal, September 12, 2014, Accessed December 13, 2014, http://www.wsj.com/articles/eu-ukraine-russia-reach-deal-on-association-agreement-1410546041.

[13] Dickel, Hassanzadeh, Henderson, Honoré, El-Katiri, Pirani, Rogers, Stern and Yafimava, “Reducing European Dependence on Russian Gas: distinguishing natural gas security from geopolitics”, pp. 66-67.

[14] Andreas Goldthaua, Tim Boersma, “The 2014 Ukraine-Russia crisis: Implications for energy markets and scholarship”, Energy Research & Social Science 3 (2014), Elsevier, pp. 13-15, May 8, 2014, Accessed December 9, 2014, http://belfercenter.ksg.harvard.edu/files/The%202014%20Ukraine-Russia%20Crisis%20-%20Implications%20for%20Energy%20Markets%20and%20Scholarship.pdf.

[15] John Kerry Secretary of State, “Remarks at U.S.-EU Energy Council”, European External Action Service Brussels, Belgium, December 3, 2014, Accessed December 9, 2014, http://www.state.gov/secretary/remarks/2014/12/234652.htm.

[16] Suzan Fraser and Vladimir Isachenkov, “Putin says Russia will scrap South Stream gas pipeline”, Associated Press, December 1, 2014, Accessed December 9, 2014, http://bigstory.ap.org/article/957862a148154d40acf04bb13a3b2bde/putin-visit-turkey-amid-syria-differences.

[17] Andrew Rettman, “Putin says will not build South Stream gas pipeline”, EU Observer, December 2, 2014, Accessed December 8, 2014, http://euobserver.com/foreign/126749.

[18] Alexander Panin, “Russia’s South Stream Alternative Rests on Shaky Ground”, The Moscow Times, December 7, 2014, Accessed December 8, 2014, http://www.themoscowtimes.com/business/article/512694.html.

[19] Christopher Weafer, “South Stream Cancellation Hits Europe Hardest”, Russia in Global Affairs, December 6, 2014, Accessed December 13, 2014, http://eng.globalaffairs.ru/book/South-Stream-Cancellation-Hits-Europe-Hardest-17167.

[20] Maria Savel, “Energy Trumps Politics in Turkey-Russia Relationship”, World Politics Review, December 8, 2014, Accessed December 13, 2014, http://www.worldpoliticsreview.com/trend-lines/14612/energy-trumps-politics-in-turkey-russia-relationship#.

[21] Nebojsa Malic, “Turkey’s Gas Deal with Russia is a Geopolitical Game-Changer”, Russia Insider, December 8, 2014, Accessed December 14, 2014, http://russia-insider.com/en/business_opinion/2014/12/07/05-33-31pm/no_secret_behind_south_stream_cancellation_moscow_just_got.

[22] Drew Leifheit, “Canceling South Stream: Everybody Wins”, Natural Gas Europe, December 11, 2014, Accessed December 15, 2014, http://www.naturalgaseurope.com/south-stream-dvid-kornyi.

[23] Thomas De Waal, “Winners and Losers in the Black Sea Gas Game”, Carnegie Moscow Center, December 3, 2014, Accessed December 16, 2014, http://carnegie.ru/eurasiaoutlook/?fa=57370.

[24] Alexandra Hudson, “Merkel urges Bulgaria to seek new talks with Putin on South Stream”, Reuters, December 15, 2014, Accessed December 16, 2014, http://uk.reuters.com/article/2014/12/15/bulgaria-gas-southstream-idUKL6N0TZ2BS20141215.